Smart Money Concepts: The Ultimate Guide to Trading Like Institutional Investors in 2025

Tired of being on the wrong side of trades? Discover Smart Money Concepts (SMC) – the framework institutional traders use to move markets. Learn how banks and hedge funds create traps for retail traders, and how to spot their footprints to trade alongside them instead of against them.

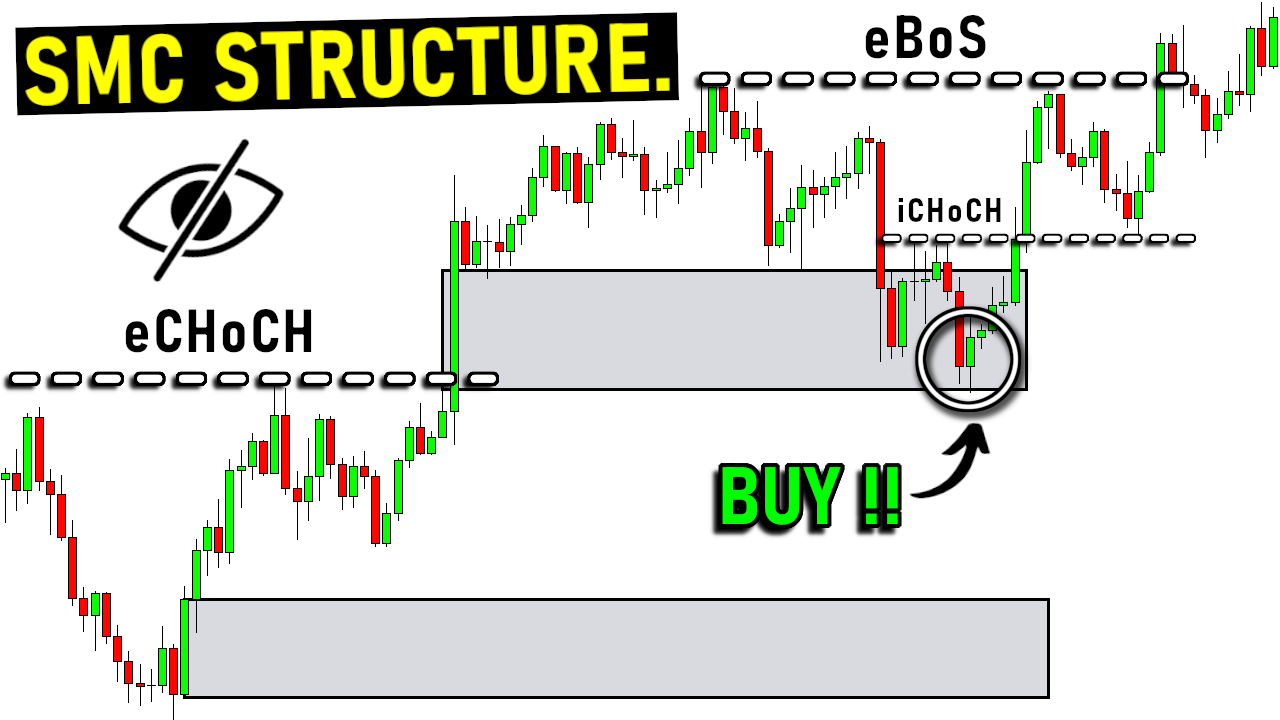

Smart Money Market Structure Trading: The Ultimate 2025 Guide

Want to learn about the power of smart money market structure trading? In this blog post, you will discover how recognizing uptrends, downtrends, and consolidation phases can help you identify key support and resistance levels, detect crucial signals like BOS and CHOCH, and build a robust trading strategy that aligns with institutional moves.

Smart Money Trading Strategy: How to Trade Like The Banks

Want to trade like the billionaires and hedge funds? Learn how smart money investors build winning portfolios and explore AI-powered trading strategies with InvestingPro, featuring 2,000%+ returns and proven data-driven trading tools!

Who Trades in the Stock Market? Exploring Retail Investors, Smart Money, and Market Makers

Ever wondered who really drives the stock market? From retail investors with limited tools to institutional players wielding immense resources, and market makers ensuring seamless trades, each plays a critical role in shaping the market dynamics. Dive in to uncover how these participants interact and where you fit in!

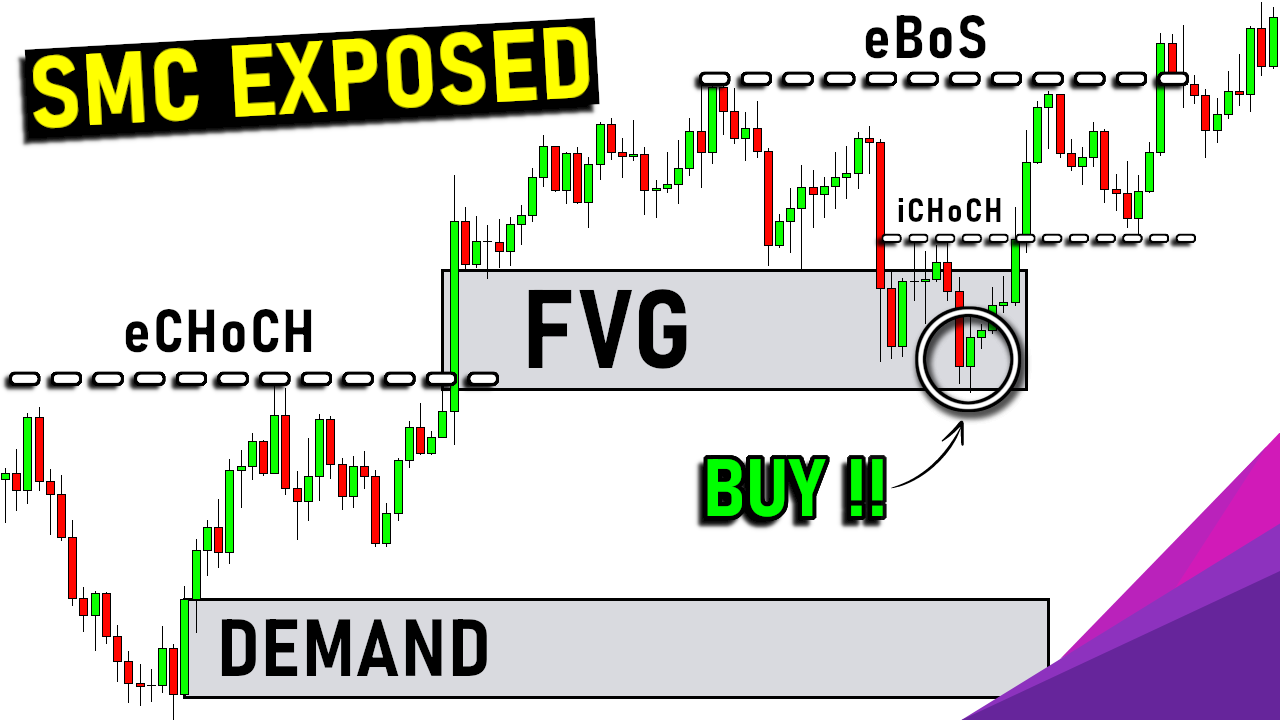

Understanding Fair Value Gaps (FVG) in Trading: An In-Depth Guide

Fair Value Gaps (FVG) are a core technique in Smart Money Concepts (SMC). In today’s blog post, you will learn everything you need to know about Fair Value Gaps. You will discover the difference between bullish and bearish Fair Value Gaps, how to identify them, the distinction between Fair Value Gaps and supply and demand zones, and much more.