Mastering Market Structure Trading: The Ultimate Guide 2025

Market structure trading is key to navigating the stock, forex, and crypto markets. This guide covers everything you need to know, from trend patterns and multi-timeframe analysis to Change of Character (CHoCH), Break of Structure (BoS), Fibonacci retracements, and entry strategies like pullbacks and failure tests. Whether you're a beginner or an experienced trader, you'll gain valuable insights. Prefer video? Watch the full Market Structure Trading Course on YouTube.

Smart Money Market Structure Trading: The Ultimate 2025 Guide

Want to learn about the power of smart money market structure trading? In this blog post, you will discover how recognizing uptrends, downtrends, and consolidation phases can help you identify key support and resistance levels, detect crucial signals like BOS and CHOCH, and build a robust trading strategy that aligns with institutional moves.

Top Down Analysis in Forex, Crypto and Stock Trading: Price Action & Market Structure

Top-Down Analysis is a proven technique used by professional traders in forex, stock, and crypto markets to dramatically improve trade accuracy. By strategically analyzing higher, medium, and lower time frames, you'll identify hidden trends, powerful support and resistance levels, and precise entry and exit points that other traders miss. Whether you're a beginner or experienced trader, this step-by-step guide will show you exactly how to implement top-down analysis to potentially transform your trading results.

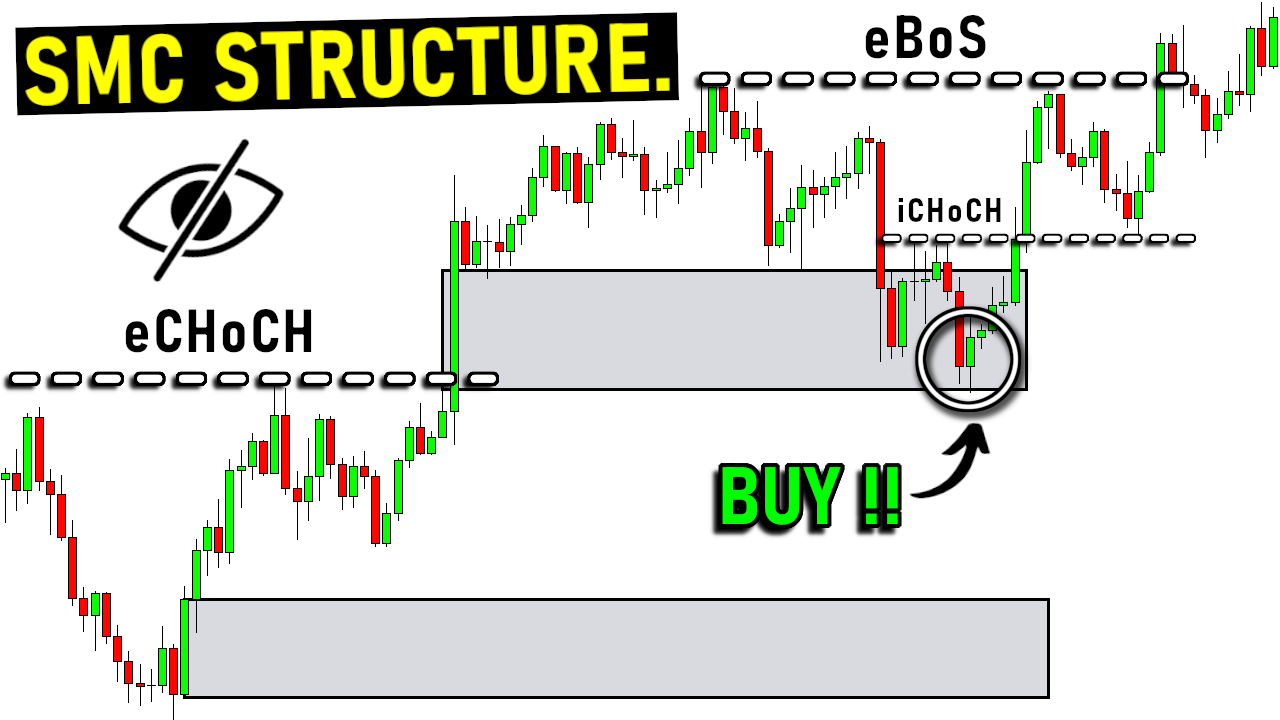

Break of Structure (BOS) and Change of Character (CHOCH) Trading Strategy

What is the difference between Break of Structure (BOS) and Change of Character (CHOCH)? In this article, you'll explore BOS and CHOCH, understand why these concepts are crucial for traders, and learn the distinctions between internal and external BOS and CHOCH.

Master Market Structure Trading in 2025: Shifts, Breaks, BoS, CHoCH, and Trends

Market structure trading might sound confusing when you first hear about it. You may have questions like: How do you identify trends in the market? What is a break of structure? What is Smart Money? In this blog post, I will simplify market structure trading and explain it in a straightforward, step-by-step manner.

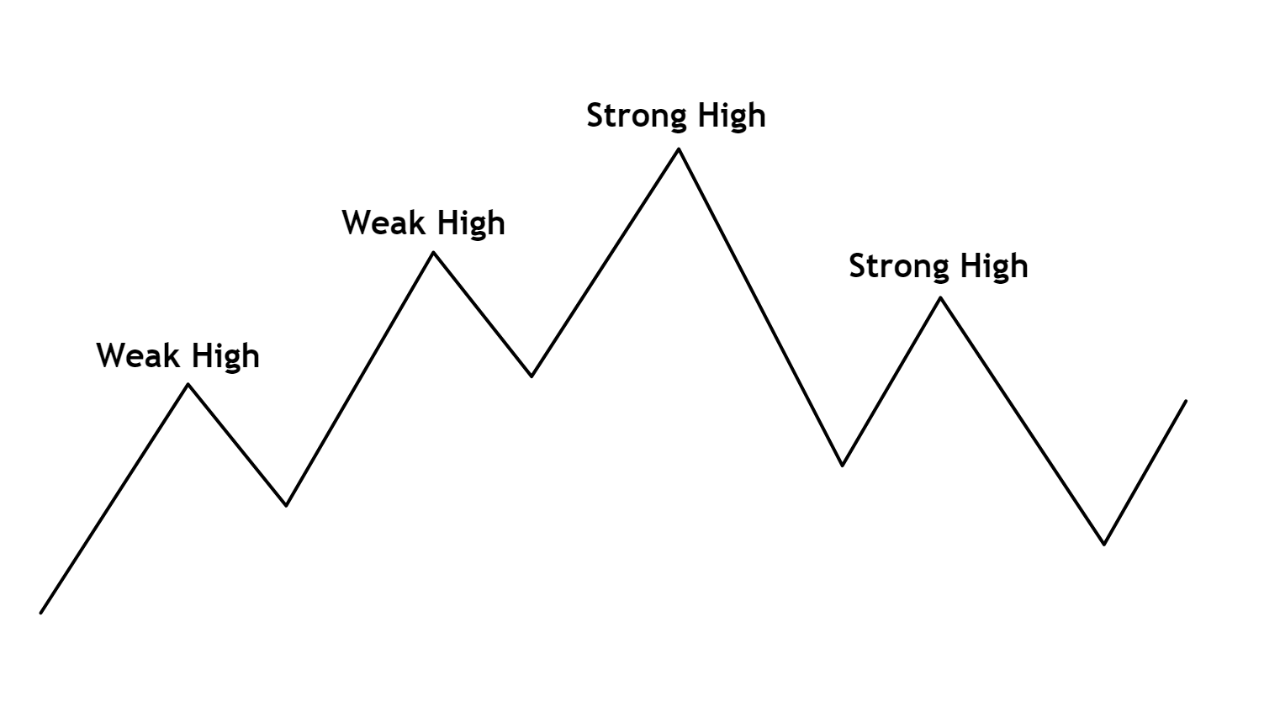

Understanding Strong Highs, Weak Highs, Strong Lows, and Weak Lows in Market Structure Trading

Navigating the complexities of market structure trading can be daunting, but mastering the concepts of strong and weak highs and lows can greatly enhance your strategy. This article simplifies these concepts, guiding you through their identification and implications for making smarter trading decisions. For visual learners, a comprehensive video explanation is also available on the Mind Math Money YouTube channel.

Trading Swing Highs and Swing Lows: An Essential Guide for Traders

Understanding market structure is crucial for trading success. In this guide, we explore a swing high swing low trading strategy, teaching you how to identify these key points on a chart. Learn how to determine trends, recognize Break of Structure (BOS) and Change of Character (CHOCH), and analyze real charts to improve your trading decisions.