Understanding the MACD Indicator: MACD Line, Signal Line, Histogram, Crossover and Zero Line

In this guide, we’re going to dive into how the MACD indicator works, covering everything from the MACD line to the signal line and histograms. This article is perfect for traders who want a comprehensive understanding of the MACD and how to apply it in their trading strategies. Whether you’re into day trading, forex trading, or looking to improve your stock market performance, mastering the MACD indicator can give you an edge.

What is the MACD Indicator?

The MACD indicator is a popular tool used in technical analysis that helps traders identify trends, potential reversals, and momentum in a given asset. MACD stands for Moving Average Convergence Divergence, and the indicator consists of three main parts:

The MACD line

The signal line

The histograms

Let's break down each component and understand how they work together.

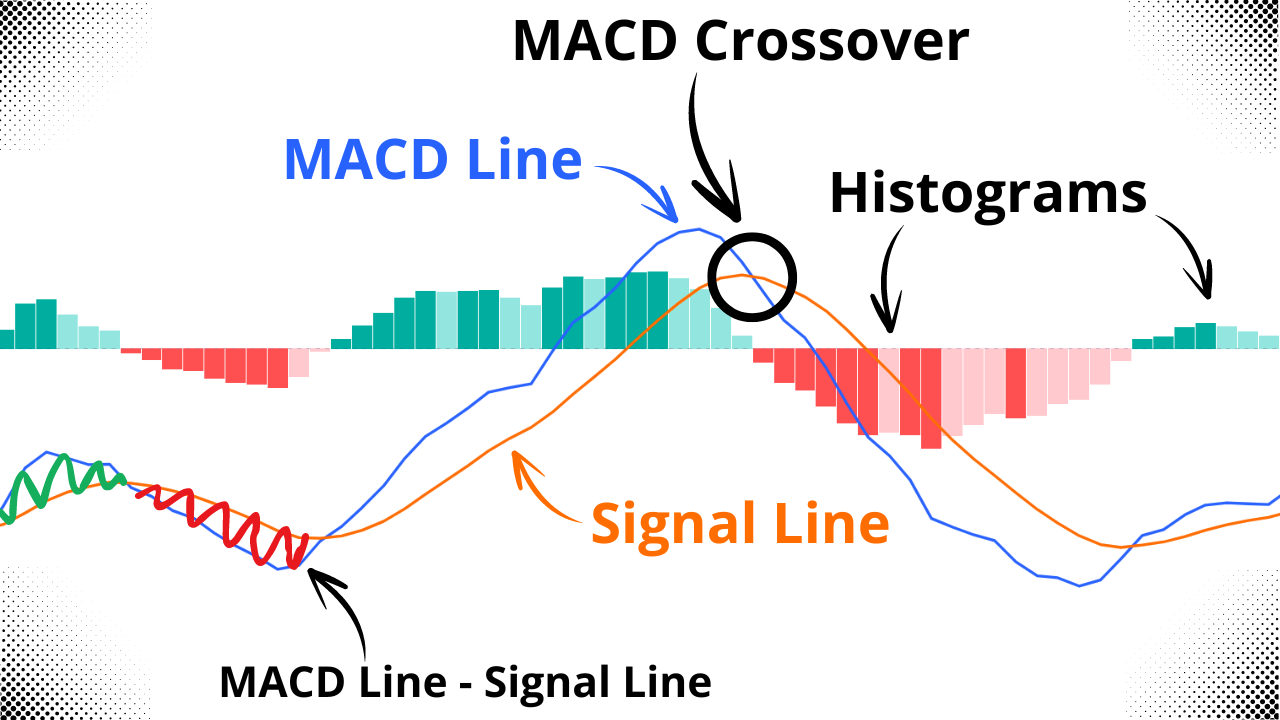

MACD Crossover, MACD Line, Signal Line, and MACD Histograms

The MACD Line

The MACD line is the primary line of the indicator and is typically displayed in blue on most charting platforms like TradingView. It is calculated by taking the difference between two exponential moving averages (EMAs):

A short-term EMA (standard setting is 12 periods)

A longer-term EMA (standard setting is 26 periods)

In other words, the MACD line = 12-period EMA - 26-period EMA.

This calculation helps traders identify the momentum in the price of an asset, with positive values indicating upward momentum and negative values indicating downward momentum.

MACD Line

Customizing the MACD Line

If you want to adjust the MACD line settings, most platforms allow you to change the number of periods used for the short-term and long-term EMAs. However, the standard 12, 26, 9 MACD settings are widely used and are effective for most trading strategies.

The Signal Line in MACD

Next, we have the signal line, which is usually displayed in orange. The signal line is simply a 9-period simple moving average (SMA) of the MACD line. Because it's a moving average of the MACD line, it smooths out the data and gives a more clear indication of when trends might be changing.

Signal Line Crossovers

One of the most common MACD trading strategies involves watching for crossovers between the MACD line and the signal line.

When the MACD line crosses above the signal line, it is typically seen as a bullish signal.

When the MACD line crosses below the signal line, it’s often viewed as a bearish signal.

These crossovers are easy to spot and provide great entry and exit points for trades.

MACD Signal Line

The MACD Histograms

The histogram in the MACD represents the difference between the MACD line and the signal line. When the two lines are far apart, the histogram bars are larger. When the lines are close together or crossing, the histogram bars are smaller. The histogram helps traders visualize the momentum and strength of a move.

Positive histogram bars (above the zero line) indicate that the MACD line is above the signal line, showing upward momentum.

Negative histogram bars (below the zero line) indicate that the MACD line is below the signal line, showing downward momentum.

MACD Histogram Strategy

A common MACD histogram strategy is to look for divergence between the price of an asset and the MACD histogram. For example, if the price is making higher highs, but the histogram is making lower highs, it could signal a potential reversal.

MACD Histogram

What is the MACD Zero Line?

The zero line (or MACD zero line) is the line that separates the positive and negative values of the MACD line and histograms. When the MACD line crosses the zero line, it signifies a key point in trend analysis.

MACD line crossing above the zero line: The 12-period EMA has crossed above the 26-period EMA, suggesting a potential bullish trend.

MACD line crossing below the zero line: The 12-period EMA has crossed below the 26-period EMA, indicating possible bearish momentum.

The zero line helps traders quickly determine whether an asset is in an overall uptrend or downtrend.

MACD Zero Line

Customizing the MACD for Different Markets

The standard MACD settings (12, 26, 9) work well in many markets, but you can adjust the parameters to fit your specific needs. For day trading or forex trading, some traders prefer to use shorter EMAs (e.g., 8 and 21) to respond faster to price movements. On the other hand, longer EMAs (e.g., 50 and 200) are often used for longer-term trading.

Experiment with different settings on your charts to find what works best for your trading style.

MACD Crossover Strategy

The MACD crossover strategy is one of the most popular uses of this indicator. By focusing on the points where the MACD line crosses the signal line and the zero line, traders can time their entries and exits with more precision. Many traders combine the MACD with other indicators, such as RSI or Bollinger Bands, to confirm the strength of the signal.

Conclusion: Mastering the MACD Indicator for Trading

The MACD indicator is a versatile and powerful tool for traders in various markets. Whether you're trading stocks, forex, or crypto, the MACD line, signal line, and histograms can help you better understand market momentum and potential trend reversals.

To get the most out of the MACD, remember these key points:

Pay attention to histograms to gauge the strength of a move.

Watch the zero line to confirm the overall trend direction.

Pay attention to MACD divergence for potential reversals.

By mastering the MACD and integrating it into your trading strategy, you’ll be better equipped to make informed decisions and improve your trading performance. If you're ready to dive deeper into technical analysis, consider exploring our full trading course for more advanced strategies!