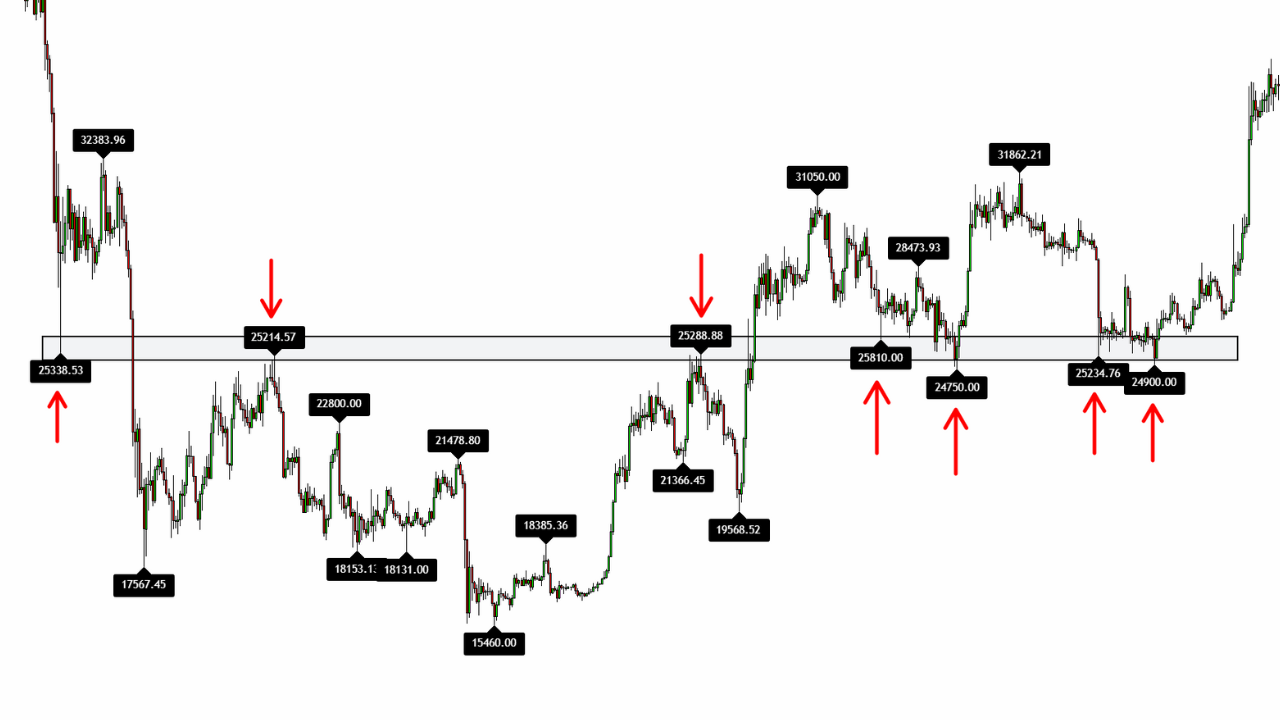

Support and Resistance TradingView Indicator: The Pivot Point Trading Strategy

The Pivot Points High and Low Indicator is one of the most effective tools on TradingView for identifying key support and resistance levels. In this article, you'll learn how to set it up and use it step-by-step to potentially improve your trading strategy.

The RSI Indicator: How to use the RSI Indicator (Relative Strength Index) for Trading Crypto, Forex, and Stocks.

In this article, you'll learn everything about the RSI Indicator (Relative Strength Index) — what it is, how it relates to momentum, RSI divergences, and much more!

Volume Analysis in Trading: A Guide to Volume Indicators and Strategies

Volume analysis is a critical skill that separates successful traders from the crowd. In this comprehensive guide, we'll break down exactly what volume trading is, why it's essential for confirming price movements, and how to combine volume indicators with price action to identify high-probability trading opportunities. Whether you're trading stocks, forex, or cryptocurrencies, mastering volume analysis will help you confirm trends, spot potential reversals, and make more confident trading decisions.

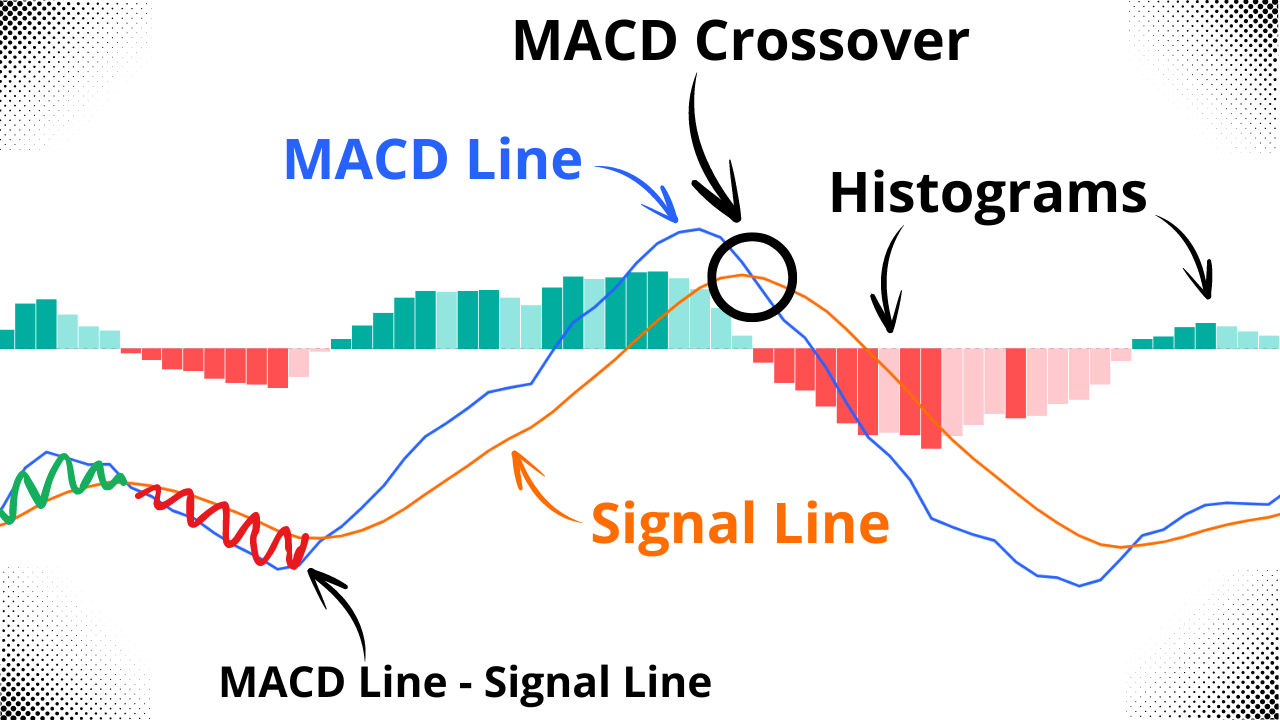

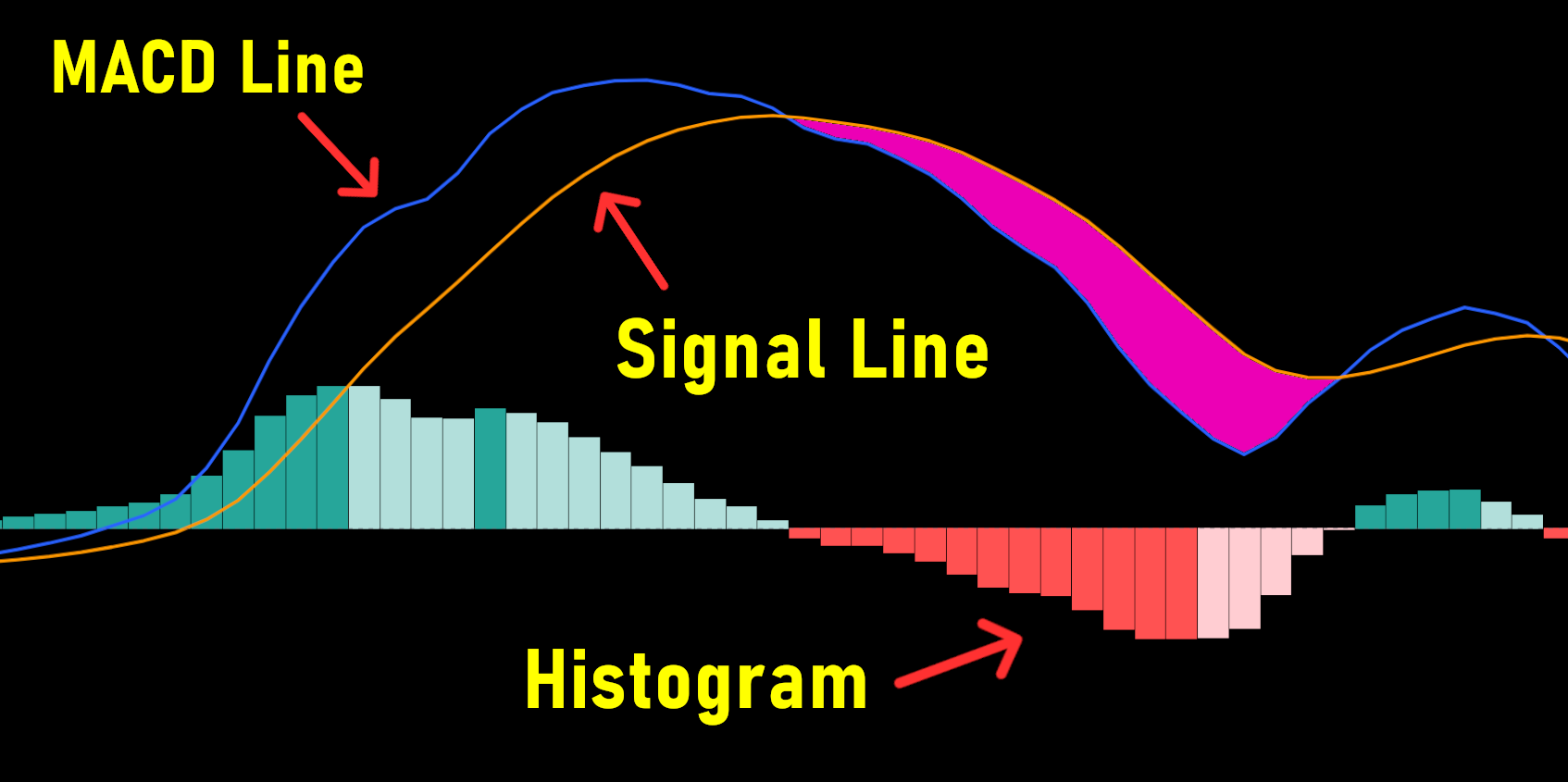

Understanding the MACD Indicator: MACD Line, Signal Line, Histogram, Crossover and Zero Line

What is MACD? If you've been trading for a while, you've likely come across the MACD indicator. While it might seem complex at first glance, the MACD is actually straightforward and highly effective. In this article, you'll learn how the MACD indicator works, and its key components: the MACD line, signal line, histogram, and zero line.

How to Draw Fibonacci Extensions: Fibonacci Extension Levels, Targets, and Trading Strategy

In this Fibonacci Extension trading guide, we delve into how to identify key target levels using Fibonacci extensions. Learn to pinpoint precise entry and exit points by recognizing swing highs and lows, and discover the significance of critical levels like 0.786, 1.0, and 1.618.

Understanding the Simple Moving Average (SMA) Trading: A Quick Guide

The Simple Moving Average (SMA) is fundamental for identifying trends and market conditions, but there's no magic SMA period that works for all situations. This guide debunks common SMA myths, shows you how to calculate and interpret SMAs correctly, and explains how to incorporate them into a comprehensive trading strategy for stocks, forex, and crypto markets.

The RSI Indicator: How to Use Relative Strength Index Like a Pro

Master the RSI Indicator with professional trading strategies that go beyond basic overbought and oversold signals. Learn how to identify powerful RSI divergence patterns, combine RSI with double bottom formations for high-probability trades, and optimize your indicator settings for precision market analysis. This comprehensive guide corrects common RSI misconceptions and reveals how successful traders truly leverage this popular momentum indicator for better trading decisions.

MACD Indicator Explained for Beginners

Unlock the MACD indicator’s power with this 2025 beginner guide. Learn to use its formula (12- and 26-period EMAs), spot crossovers, and identify divergences for smarter trading. Updated with practical examples and interactive tools, this guide shows how MACD reveals trends and momentum—perfect for new traders or anyone sharpening their skills. Pair it with other indicators and start trading confidently!