Understanding Break of Structure (BOS) and Change of Character (CHOCH) in Trading

If you're aiming to improve your trading skills, learning about BOS (Break of Structure) and CHOCH (Change of Character) should be at the top of your list. This concise article not only explains what BOS and CHOCH are but also delves into why they are crucial for predicting market movements and making informed decisions.

How to Trade the Double Top and Double Bottom Pattern

Discover the power of the Double Top and Double Bottom chart patterns in this guide. These chart patterns offer clear signals for bullish and bearish reversals across forex, crypto, stock markets. They can be used whether you are day trading or swing trading.

Understanding the Simple Moving Average (SMA)

Discover the truth behind the Simple Moving Average (SMA) in our latest guide. Debunking common myths, we delve into the essence of SMAs, revealing how they're not about choosing the "best" number but understanding their strategic application in trading

Understanding Trading Order Types: A Beginner's Guide

This article delves into the basics of trading order types, offering a straightforward guide for beginners. We will cover the market order, buy limit, sell limit, and sell stop orders. Some advanced trading order types will also be discussed.

Overbought and Oversold in Trading: A Beginner's Guide

Learn about what overbought and oversold means in trading with this beginner-friendly guide. We will talk about the meaning of overbought and oversold but also how you can identify these conditions using the RSI indicator.

The RSI Indicator: How to Use the Relative Strength Index

Improve your trading game with a clear guide on using the Relative Strength Index (RSI Indicator) effectively. This article breaks down the basics, from correcting common misconceptions to applying the RSI strategies that professional traders use. Learn about the significance of RSI divergence, the integration of double-bottom patterns, and how to optimize RSI settings for better market analysis.

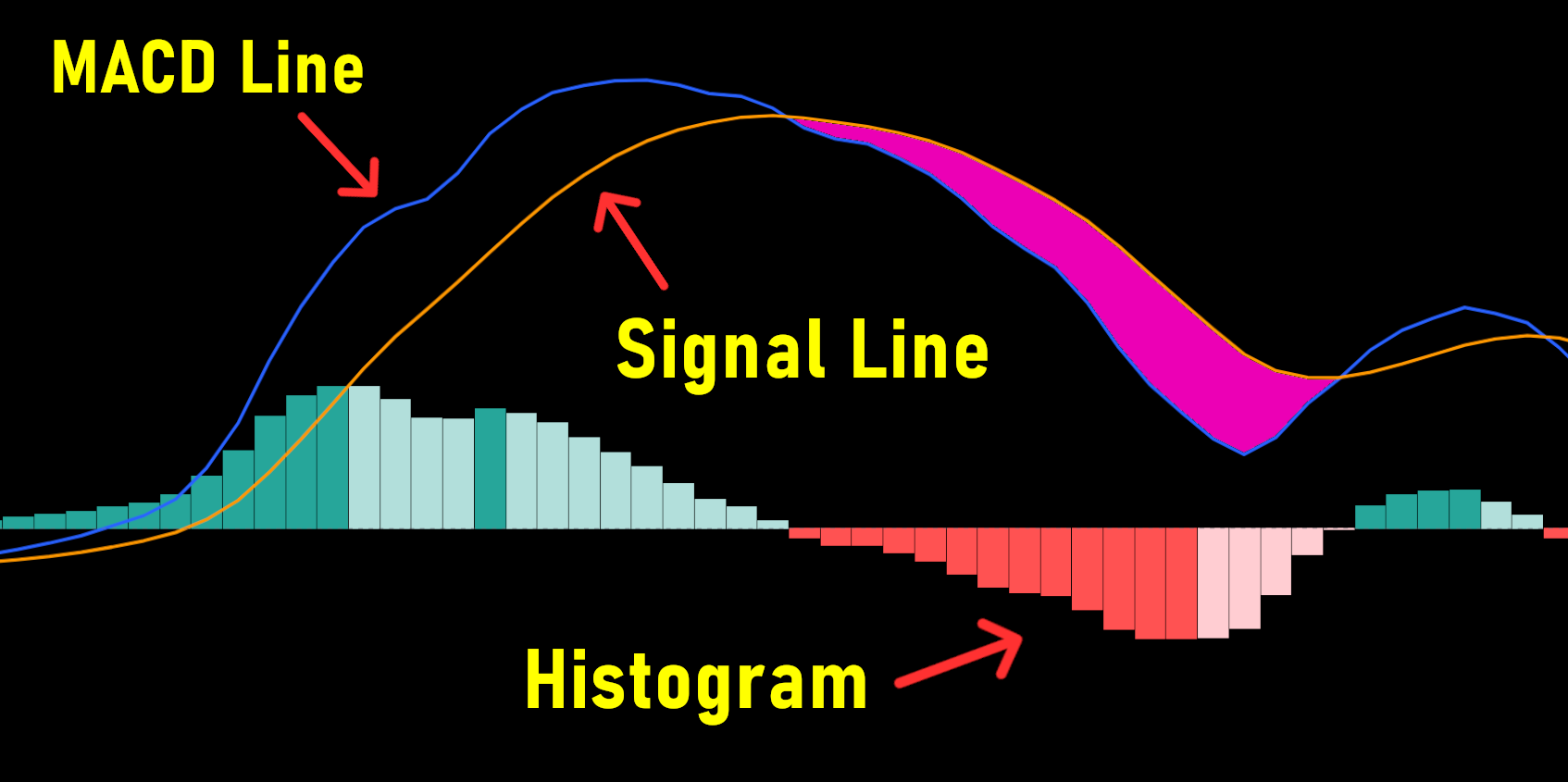

MACD Indicator Explained for Beginners

In this guide, we delve into the MACD (Moving Average Convergence Divergence), a trading indicator used to understand market trends and momentum. Beyond basics, it includes practical examples of MACD trading techniques. For beginners and seasoned traders, the MACD indicator is worth exploring!

How to Use the RSI Indicator in TradingView

Unlock the potential of the Relative Strength Index (RSI) in TradingView with our short guide. Discover how to effectively add and interpret this crucial momentum indicator to improve your trading. Learn the significance of overbought and oversold conditions and master the art of identifying RSI divergences for better market predictions. Whether you're a novice or an experienced trader, this guide can elevate your technical analysis skills. Dive in to explore the synergy of RSI with other indicators like the moving average for a more robust trading approach.

How To Add Moving Averages in Tradingview

Learn the simple steps to add Moving Averages in TradingView. Our guide takes you through the process, ensuring you can confidently apply both the simple moving average (SMA) and exponential moving average (EMA) to TradingView.