Volume Analysis in Trading: A Guide to Volume Indicators and Strategies

Understanding volume analysis in trading is something you can't do without as a trader. In this article, we will break down what volume trading is, why it's important, and how to use the volume indicator together with price action signals to improve your trading strategies.

Fibonacci TradingView Settings: The Golden Zone

The Fibonacci Golden Zone is one of the best Fibonacci Retracement settings. In this article, you’ll learn how to set up the Fibonacci Golden Zone step-by-step.

What is Crypto? A Simple Guide to Understanding Cryptocurrency

Crypto has taken the world by storm, but many still wonder, "What is crypto?". In this blog post, you'll learn the basics of cryptocurrency, blockchains, nodes, Bitcoin, and more! Whether you're a beginner or looking to deepen your understanding of crypto, this article is for you!

Break of Structure (BOS) and Change of Character (CHOCH) Trading Strategy

What is the difference between Break of Structure (BOS) and Change of Character (CHOCH)? In this article, you'll explore BOS and CHOCH, understand why these concepts are crucial for traders, and learn the distinctions between internal and external BOS and CHOCH.

Understanding Smart Money Concepts (SMC) in Trading: A Comprehensive Guide

What is Smart Money Concepts in Trading? If you're looking to understand smart money concepts (SMC Trading), you've found the right article. In this blog post, you will learn how institutional investors like banks and hedge funds influence market movements and how we, as retail traders, can take advantage of these insights.

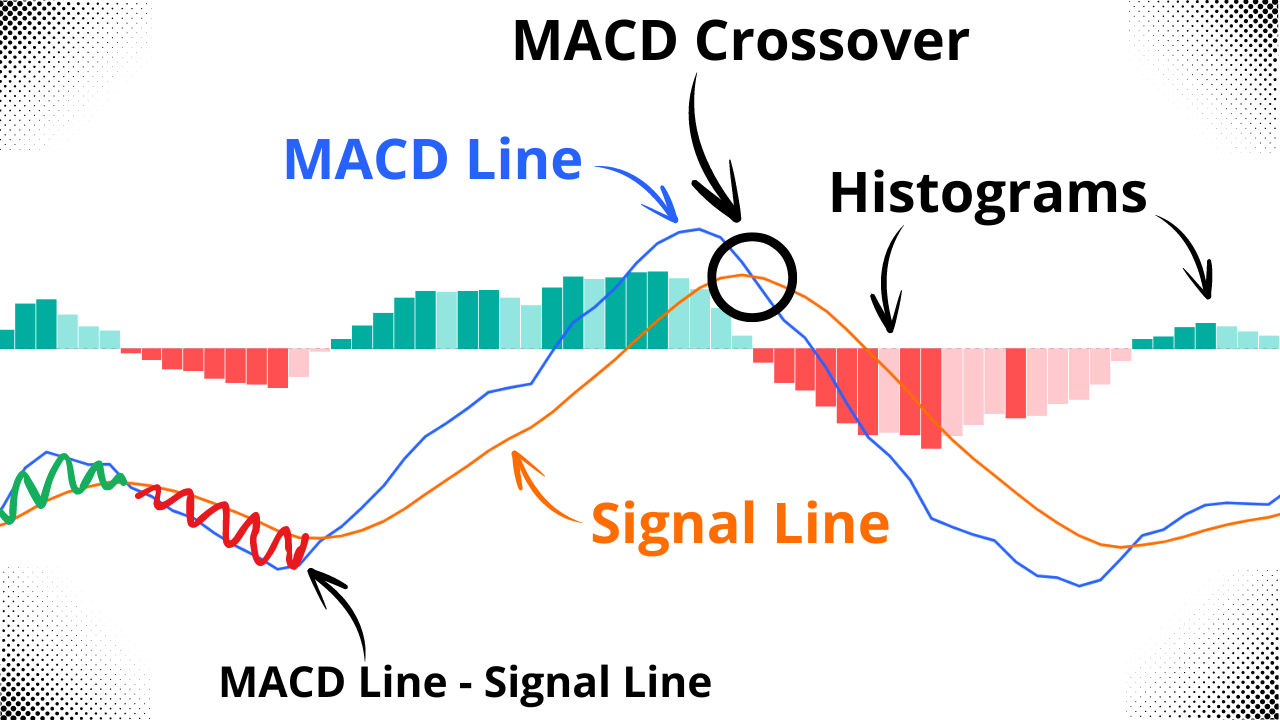

Understanding the MACD Indicator: MACD Line, Signal Line, Histogram, Crossover and Zero Line

What is MACD? If you've been trading for a while, you've likely come across the MACD indicator. While it might seem complex at first glance, the MACD is actually straightforward and highly effective. In this article, you'll learn how the MACD indicator works, and its key components: the MACD line, signal line, histogram, and zero line.

What is a Stablecoin? Understanding Tether (USDT), USDC, and DAI

What is a stablecoin? If you're interested in crypto trading, this is an important question. In this short guide, you'll learn what stablecoins are, their different types, and why they play a vital role in the crypto market.

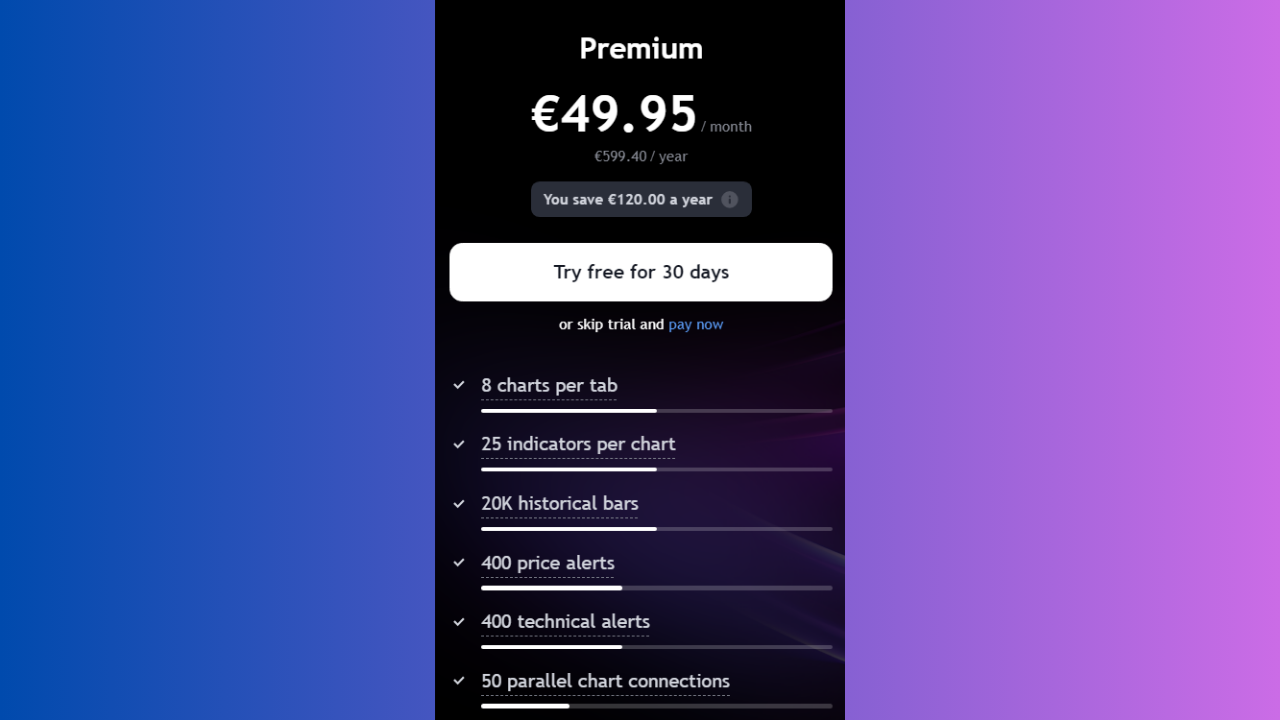

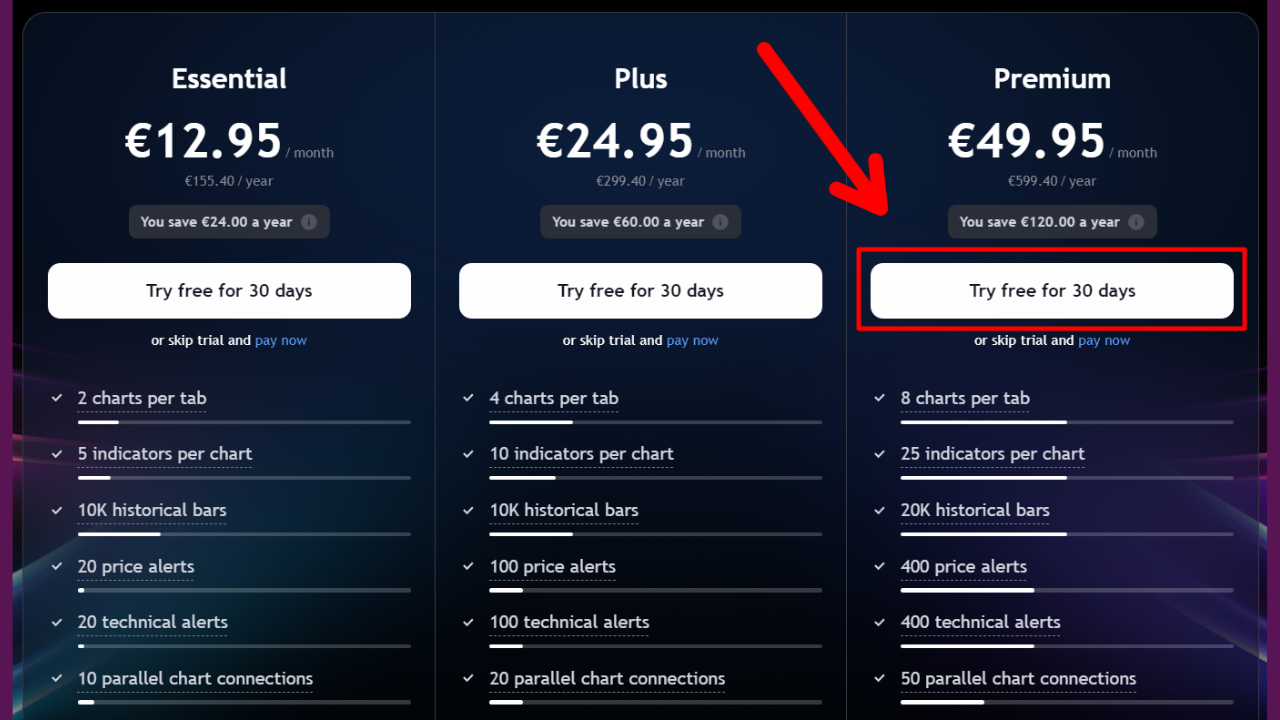

TradingView Plans Comparison: Free vs Essential vs Plus vs Premium

Which TradingView plan is best for you? With over 60 million users worldwide, TradingView is a top platform for charting, trading, and market analysis. In this article, we'll compare the Basic, Essential, Plus, and Premium plans to help you find the right fit.

What is Price Action Trading?

What is Price Action Trading? It's a common, but unfortunately often misunderstood question. Many new traders confuse price action with market structure, and as a result, make trading harder for them. In this blog post, you will learn what price action trading is and how it's different from market structure.

The Doji Candlestick Pattern: Dragonfly, Gravestone, Long-Legged, and Four Price Doji

Every trader should understand Doji Candlesticks. Why? Because Doji Candlestick Patterns, or simply Doji Candles, frequently appear in all markets—whether forex, crypto, or stocks—and provide crucial insights into potential price movements. In this blog post, you’ll discover the most important types of Doji Candles and how to trade them effectively.

Liquidity Grab in Trading: Meaning, Trading Strategy, and Pattern

The Liquidity Grab is a smart money concept every trader should learn! In today’s blog post, you will discover all you need to know about liquidity grabs including liquidity zones and trading strategies that work whether you are trading forex, stocks, or crypto. What are you waiting for? Let’s learn how to identify and trade liquidity grabs right away!

The Arnaud Legoux Moving Average (ALMA): Moving Average Trading

Master the ALMA (Arnaud Legoux Moving Average) indicator to elevate your trading strategy with a blend of smoothness and responsiveness. In this comprehensive guide, we delve into the unique features of ALMA, comparing it with other popular moving averages like SMA, EMA, and HMA. Learn how to set up and optimize ALMA for various market conditions, from volatile cryptocurrencies to stable blue-chip stocks.

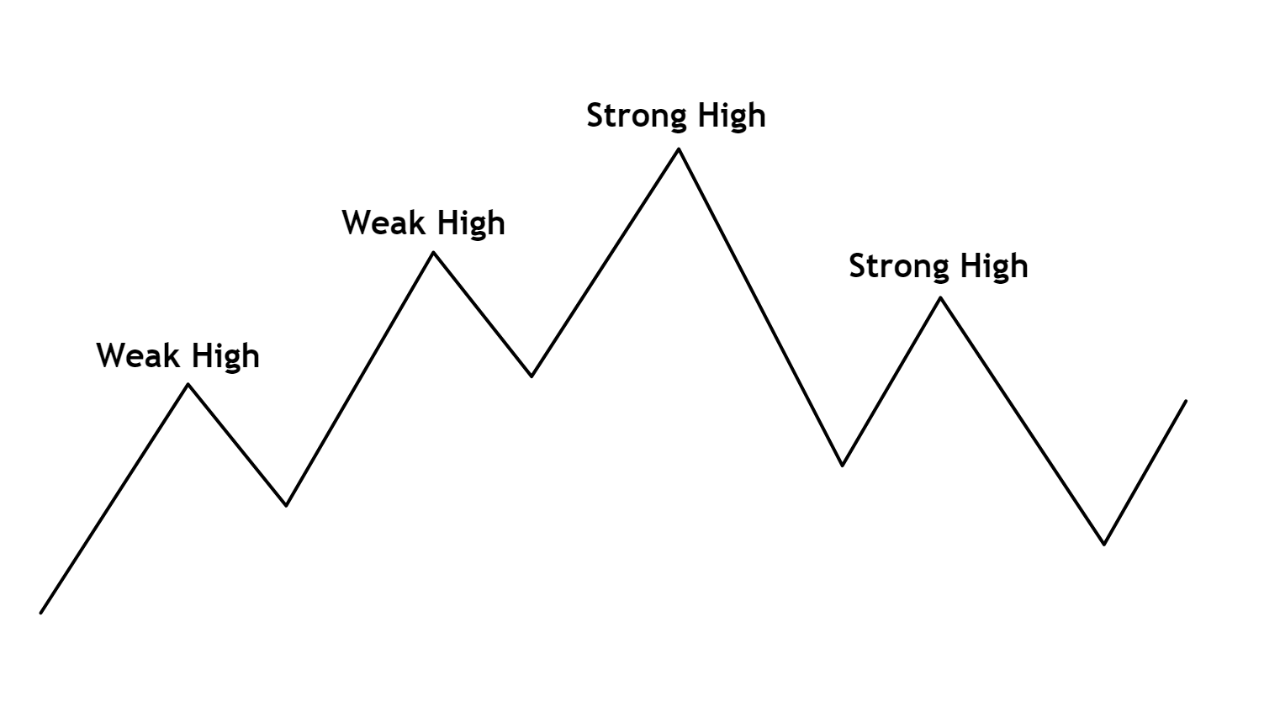

Master Market Structure Trading: Shifts, Breaks, BoS, CHoCH, and Trends

Market structure trading might sound confusing when you first hear about it. You may have questions like: How do you identify trends in the market? What is a break of structure? What is Smart Money? In this blog post, I will simplify market structure trading and explain it in a straightforward, step-by-step manner.

Understanding Fair Value Gaps (FVG) in Trading: An In-Depth Guide

Fair Value Gaps (FVG) are a core technique in Smart Money Concepts (SMC). In today’s blog post, you will learn everything you need to know about Fair Value Gaps. You will discover the difference between bullish and bearish Fair Value Gaps, how to identify them, the distinction between Fair Value Gaps and supply and demand zones, and much more.

How to Draw Fibonacci Extensions: Fibonacci Extension Levels, Targets and Trading Strategy

In this Fibonacci Extension trading guide, we delve into how to identify key target levels using Fibonacci extensions. Learn to pinpoint precise entry and exit points by recognizing swing highs and lows, and discover the significance of critical levels like 0.786, 1.0, and 1.618.

Free TradingView Premium: Is it Possible?

Is it possible to get TradingView Premium for free? In this blog post, you will discover how to obtain a free but limited-time TradingView Premium subscription. You will learn about the 30-day free TradingView Premium trial and the steps needed to unlock it, how to claim a $15 bonus towards new TradingView plans, and much more.

RSI Divergence Trading Strategy: Forex, Crypto, and Stock Trading

Discover the power of RSI Divergence in trading with our comprehensive guide. This article breaks down the four key types of divergence—bullish, bearish, hidden bullish, and hidden bearish—and explains how to use them effectively in forex, crypto, and stock markets. Perfect for beginners, our step-by-step approach and practical examples will help you master this essential trading strategy and improve your trading success.

Understanding Strong Highs, Weak Highs, Strong Lows, and Weak Lows in Market Structure Trading

Navigating the complexities of market structure trading can be daunting, but mastering the concepts of strong and weak highs and lows can greatly enhance your strategy. This article simplifies these concepts, guiding you through their identification and implications for making smarter trading decisions. For visual learners, a comprehensive video explanation is also available on the Mind Math Money YouTube channel.

Trading Swing Highs and Swing Lows: An Essential Guide for Traders

Understanding market structure is crucial for trading success. In this guide, we explore a swing high swing low trading strategy, teaching you how to identify these key points on a chart. Learn how to determine trends, recognize Break of Structure (BOS) and Change of Character (CHOCH), and analyze real charts to improve your trading decisions.

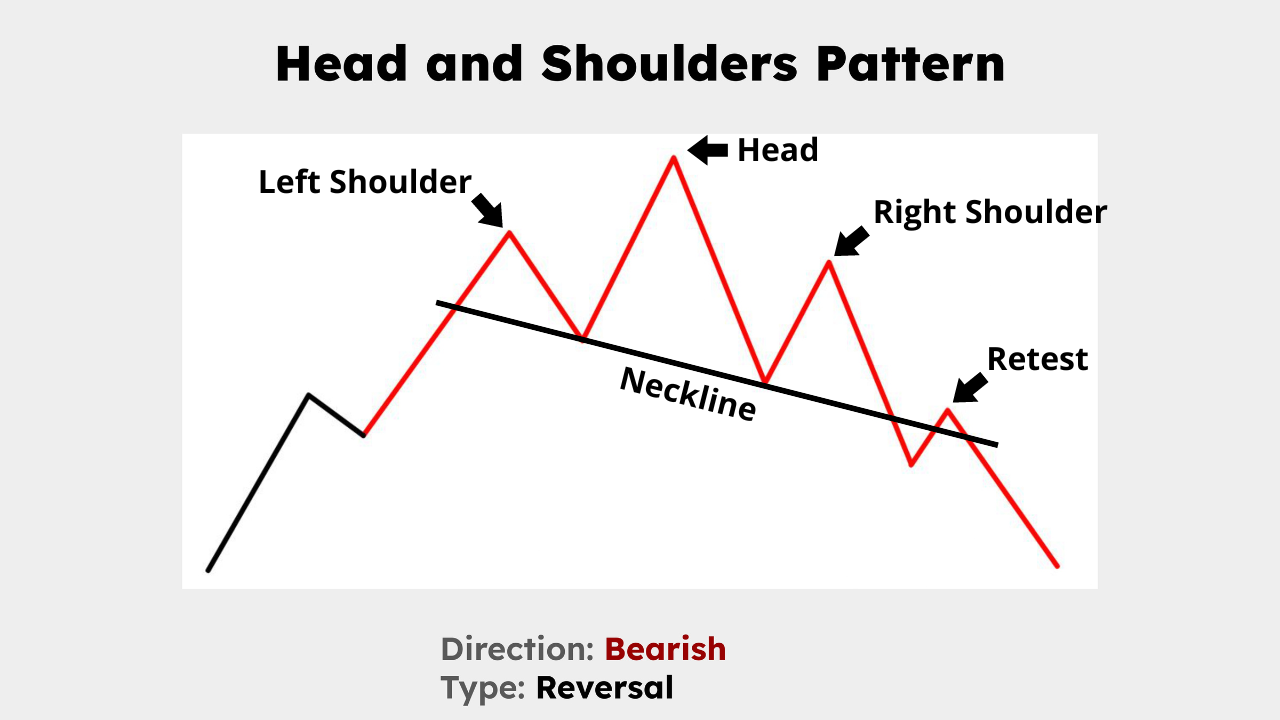

Understanding the Head and Shoulders Chart Pattern: A Comprehensive Guide

Unlock the secrets of the head and shoulders pattern, a crucial tool for spotting bearish reversals. This guide covers its structure, identification, and trading strategies, including entry points, stop loss placements and profit targets. Perfect for traders at any level, this article provides the insights needed to predict market trends effectively. Improve your trading skills with real market examples and expert tips.